Think of digital nomad health insurance as the healthcare equivalent of a global SIM card—it’s built for a life in motion. This isn't your standard vacation insurance or the rigid health plan you have back home. It's a specialized type of coverage designed to provide continuous, flexible medical protection as you immerse yourself in new cultures and work across different countries.

What is This "Global Healthcare Passport" Anyway?

Imagine your health insurance from back home is like a landline phone. It works perfectly, but only within the four walls of your country. The moment you step on a plane for a long-term stay abroad, you lose the signal.

Digital nomad health insurance is the smartphone in this scenario. It travels with you, offering a reliable connection to medical care whether you're typing away in a Lisbon café, collaborating in a Chiang Mai coworking space, or waking up to ocean views in Mexico. It’s built for a lifestyle that refuses to be tied down to a single zip code, allowing you to focus on the full cultural experience.

This insurance fills a massive gap between temporary travel policies and full-blown expat plans. Standard travel insurance is mostly for trip-related disasters—lost bags, canceled flights—and its medical coverage is usually thin and for emergencies only. On the other side, your traditional health plan from home rarely covers you for more than a few weeks abroad, leaving you dangerously exposed if you're gone for months.

Why Your Regular Insurance Just Won't Cut It

Trying to rely on your domestic plan while living abroad is one of the most common—and riskiest—mistakes nomads make. Most national or employer-sponsored plans offer little to no coverage internationally. When they do, it's typically just for life-or-death emergencies on a short trip.

This leaves you with some serious blind spots:

- Routine Care: Need a check-up, a prescription refill, or a dental cleaning? Your home plan almost certainly won't cover that abroad.

- Paying Upfront: International hospitals often demand payment on the spot. This means you could be forced to pay thousands out-of-pocket and then wrestle with your home insurer for reimbursement, a process that can be a bureaucratic nightmare.

- Visa Mandates: A growing list of countries with digital nomad visas now legally require you to show proof of comprehensive health coverage that meets their specific, often high, standards. Your domestic plan won't pass muster.

The need for this kind of insurance has exploded right alongside the remote work movement itself. Between 2019 and 2024, the number of digital nomads in the US alone shot up by 147% to 18.1 million. Globally, some estimates put the number near 40 million. This boom has finally pushed insurers to create products that actually fit the borderless lifestyle. You can learn more about the rapid growth of the digital nomad market and how it’s shaping the services we rely on.

A huge misconception is that travel insurance and health insurance are the same thing. They aren't. For a digital nomad, one is for trip mishaps, and the other is for your actual health and well-being as you live your life around the world.

To make the differences crystal clear, let's break down the three main types of insurance you'll hear about.

Quick Guide to Insurance for Global Lifestyles

Here’s a simple table to help you distinguish between the policies designed for different kinds of travel and living situations.

| Insurance Type | Best For | Typical Duration | Key Coverage Focus |

|---|---|---|---|

| Travel Insurance | Tourists on short vacations (1-4 weeks) | Days to weeks | Trip cancellation, lost luggage, flight delays, emergency medical events. |

| Digital Nomad Insurance | Remote workers and nomads staying abroad for months or years. | 3 months to multiple years | Comprehensive medical care, emergencies, routine check-ups, and continuous cross-border coverage. |

| Domestic Health Plan | Residents living and working primarily in their home country. | Annual, ongoing | In-network doctors, preventative care, and major medical within one country's system. |

In short, each plan has its place. Your domestic plan is for life at home, travel insurance is for a vacation, and digital nomad insurance is for when the world becomes your office.

Finding Your Fit Among Nomad Coverage Options

Trying to figure out digital nomad health insurance can feel like ordering coffee in a new country when you don't speak the language. Everything sounds kind of the same, but the little details make a world of difference. This isn't about finding a single "best" plan; it's about finding the right plan for your travel style and your desire for a deep, immersive experience.

The right choice really boils down to how you move through the world. Are you a fast-paced country hopper? An aspiring expat putting down roots for a year? Or are you going all-in on one culture for the long haul? Each of these paths has an insurance plan that fits.

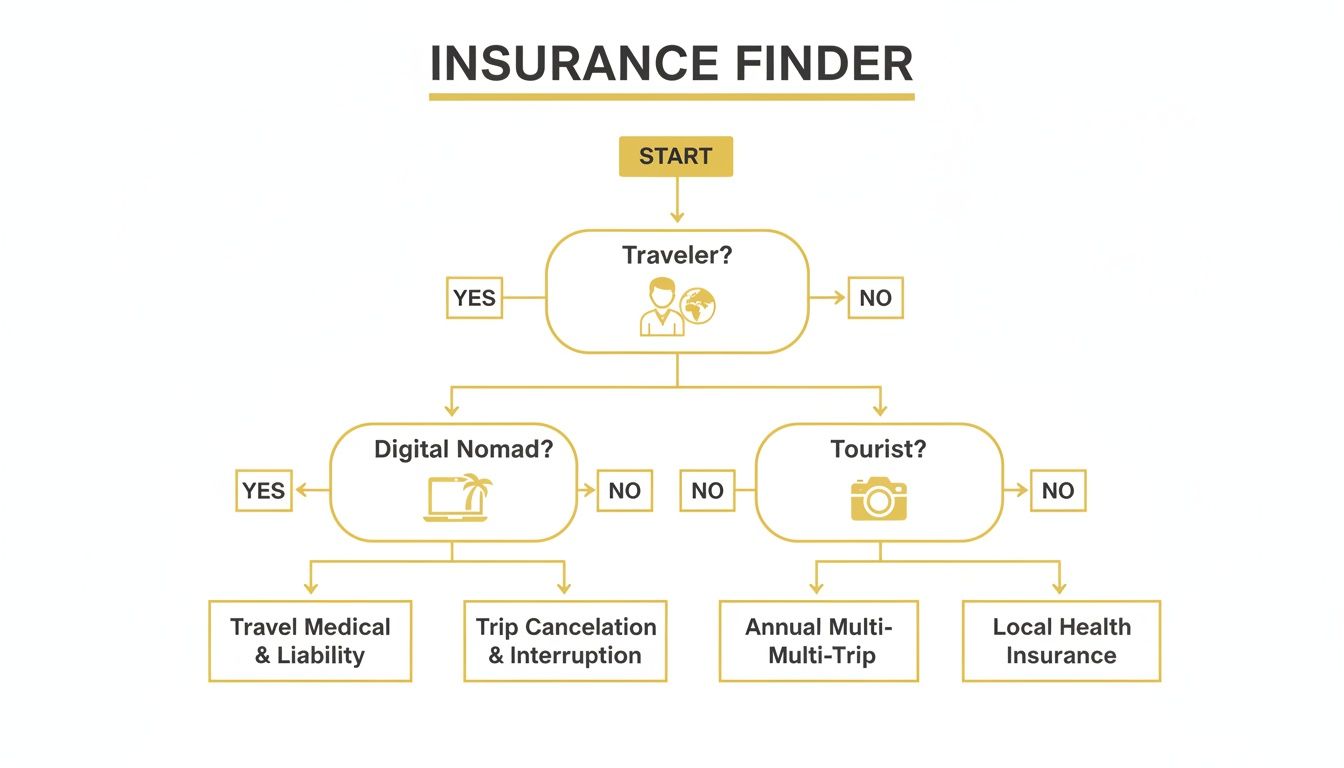

This little flowchart is a great starting point to see which path makes the most sense for you.

As you can see, the main fork in the road is your identity as a traveler. Are you essentially a tourist, or are you living abroad as a long-term nomad?

The Short-Term Safety Net: Travel Medical Insurance

Think of travel medical insurance as your emergency-only toolkit. This is the perfect fit for the nomad who moves fast, spending just a few weeks or a month in one place before heading to the next.

Its whole purpose is to cover the big, unexpected stuff—a scooter crash in Thailand, a nasty bout of food poisoning in Peru. It’s not meant for routine care, so things like annual check-ups, preventative screenings, or pre-existing conditions are almost always excluded. This keeps it affordable, making it the ideal safety net for a whirlwind tour through Southeast Asia or a multi-country Euro trip.

The Comprehensive Expat Plan: International Health Insurance

For nomads who prefer to slow down and set up a base for six months, a year, or longer, international private medical insurance is the way to go. This is your classic "expat" coverage, and it feels a lot more like a traditional health plan from back home, just with a global reach.

These plans are much broader and often cover:

- Routine Doctor Visits: For when you just need a regular check-up.

- Preventative Care: Think screenings and vaccinations to keep you healthy on the road.

- Specialist Consultations: Access to cardiologists, dermatologists, and other specialists.

- Mental Health Support: A critical, but often overlooked, need for life abroad.

Picture yourself setting up shop in Lisbon for a year to really soak in the culture. An international plan lets you manage your health proactively, not just reactively. As you dig in, it’s worth reading up on expat medical insurance and which policy type is right for you to really get the nuances of long-term coverage.

The Go-Native Option: Local National Coverage

The last option is for the nomad who's basically become a resident. If you’ve gone through the process of getting a long-term visa and plan to stay put in one country for years, enrolling in the local healthcare system might be your best bet. This is the "go-native" approach.

For instance, after getting your residency in Spain, you could potentially get on their public healthcare system. This route gives you a truly authentic connection to your new home and a full cultural experience. The downside? You'll be navigating bureaucracy in another language, and it's only possible once you have legal residency. It’s a fantastic path for those committed to a single location, and our guide on the best countries for digital nomads can point you toward destinations where this is a viable option.

Essential Coverage and What to Watch Out For

Choosing digital nomad health insurance based only on price is like picking a parachute because you like the color. It’s what’s inside that actually keeps you safe. A solid policy is your lifeline out here, and it’s built on a foundation of non-negotiable features designed to protect you from the worst-case scenarios that can, and do, happen on the road.

Think of these core components as the structural beams of your coverage. If any of them are missing, the whole plan is shaky. You need to measure every single policy you look at against this essential checklist.

The Non-Negotiables of Nomad Insurance

Before you even glance at the monthly premium, scan the policy documents for these three absolute must-haves. If any are missing or have laughably low limits, it’s a giant red flag. Just walk away.

- High Emergency Medical Limits: This is the big one. Your coverage for emergency medical and dental care needs to be at least $100,000, though honestly, higher is always better. That number sounds huge, but a serious scooter accident or a sudden illness that needs surgery and a few nights in a decent private hospital can blow past that figure shockingly fast.

- Comprehensive Medical Evacuation: Imagine you have a serious medical crisis while exploring off-the-beaten-path villages in Guatemala or a country with subpar healthcare. You’ll need to be transported to the nearest hospital that can actually handle your situation. Medical evacuation covers this, and it can easily cost tens of thousands of dollars out of pocket. Make sure your policy has it and that it's separate from repatriation (which just flies your body home).

- True Worldwide Coverage: Your plan has to cover you where you’re actually going. Most nomad-focused insurers offer a "Worldwide" plan and a "Worldwide excluding USA" option. Because healthcare costs in the United States are astronomical, including it in your plan can easily double your premium. If you don't plan on spending time there, excluding the U.S. is one of the smartest ways to save money without sacrificing quality of care elsewhere.

Your insurance policy is a legal contract that defines your access to care. The details in the fine print aren't just suggestions; they are the rules that will dictate what happens in an emergency.

With the global digital nomad population expected to hit around 40 million by 2025, the insurance market is finally heating up. This competition is great for us—it’s forcing providers to add better features like telemedicine and smoother claims processing, expanding benefits while keeping costs from skyrocketing. You can read more about the growing digital nomad insurance market to see how these trends are shaping the policies available today.

Spotting the Red Flags in the Fine Print

Now for the tricky part: the exclusions. This is where so many nomads get burned. An insurer’s main job is to manage risk, which means they will always have a list of specific situations, health conditions, and activities they absolutely will not pay for.

It's your job to find these deal-breakers before you buy. Keep an eye out for these common exclusions that can make your policy useless right when you need it most.

- Pre-existing Conditions: This is a major sticking point for almost every plan. Some policies offer zero coverage for anything related to a pre-existing condition. Others might cover an "acute onset" or an emergency flare-up but won't touch routine care for it. You have to be brutally honest with yourself about your health history and find a plan that explicitly addresses your needs.

- Extreme and Adventure Sports: Thinking about scuba diving in Belize, rock climbing in Thailand, or even just renting a scooter to explore outside the main tourist hubs? Hold on. Many basic policies exclude injuries from what they consider "hazardous" activities. You’ll often need to buy a specific adventure sports add-on or choose a plan designed for more active travelers to be covered.

- Mental Health Services: The nomad lifestyle isn’t always sunset cocktails and laptops on the beach; it can be incredibly isolating and stressful. Yet, many of the cheaper plans offer little to no coverage for therapy or mental health support. If this is a priority for you, you’ll need to look for a more comprehensive international health plan that specifically includes it.

- Routine Check-ups and Preventative Care: Most travel medical-style nomad plans are designed for emergencies only. They aren't going to cover your annual physical, dental cleanings, or other preventative care. For that kind of coverage, you're looking at a much more robust (and more expensive) international health policy.

How Nomad Visas Made Insurance Non-Negotiable

Not too long ago, getting health insurance as a digital nomad was just a smart personal decision—a safety net, but ultimately, your call. That's not the world we live in anymore. Today, governments are making that choice for you. The explosion of official digital nomad visas has completely changed the game, turning comprehensive health insurance from a “nice-to-have” into a hard-and-fast legal requirement.

Your policy isn't just for your own peace of mind now; it's your golden ticket. It has become a critical piece of paperwork, the very key that unlocks your ability to legally live and work in your dream destination for months or even years. Without it, your visa application is often dead on arrival.

This all comes down to one simple fact: countries want to attract high-earning remote workers without taking on the risk of paying for their medical care. By making private insurance mandatory, they guarantee you can support yourself, making you a self-sufficient temporary resident rather than a potential drain on their public health system.

The Visa Application Dealbreaker

Think of your visa application like a puzzle. You have your proof of income, your passport, and a clean background check. But the piece that holds it all together? Your certificate of insurance. Consulates are now looking at these policies with a magnifying glass to make sure they meet very specific—and often very strict—criteria.

For anyone chasing a long-term stay in places like Lisbon or Bali, this is one of the biggest changes we've seen. Since 2020, over 50 countries have launched or updated remote work visas, and the vast majority demand proof of health insurance. You can't even submit your application in many European and Asian hotspots without a policy that meets specific minimums for hospitalization, emergency evacuation, and sometimes even clauses for things like COVID-19.

Your insurance policy is now a legal document that proves your self-sufficiency to a foreign government. It's less about "what if I get sick?" and more about "I have the required paperwork to be approved."

This new reality forces you to choose your digital nomad health insurance with one eye on your well-being and the other on bureaucratic red tape.

Decoding Specific Country Requirements

A vague policy promise just won't fly. Countries are publishing explicit coverage minimums you have to meet. While the exact details change from place to place, a clear pattern has emerged across popular nomad hubs.

Here's a snapshot of what you're up against:

- Portugal (D8 Visa): You'll need proof of coverage for all medical expenses, including urgent care and repatriation. The policy must offer at least €30,000 in coverage and be valid across the entire Schengen Area for your full stay.

- Spain: Similar to Portugal, Spain's digital nomad visa requires a comprehensive health plan with zero co-payments. It has to cover everything from preventative care to treatment and rehab, and it must come from an insurer officially authorized to operate in Spain.

- Mexico (Temporary Resident Visa): While it used to be a bit more relaxed, consulates are now consistently asking for proof of health insurance that's valid for your entire stay. The required coverage amount can vary, but it needs to be solid enough to handle any real emergency.

Even global business hubs are getting strict. For example, a look at the Dubai freelance visa requirements shows how insurance has become an essential part of the application process.

Trying to keep up with these rules can feel like a full-time job, as every country has its own quirks. For a more detailed breakdown, check out our complete guide to digital nomad visa requirements. It gives you an in-depth look at what you’ll need for the most popular destinations. Ultimately, this shift forces all of us to be more deliberate about our insurance, ensuring we're covered both medically and legally.

On-The-Ground Insurance Tips for Nomad Hubs

Picking the right digital nomad health insurance isn’t just about comparing policy documents on a screen; it’s about knowing how that plan will actually perform in the real world. Your coverage needs change in a big way depending on whether you're navigating the scooter chaos of Southeast Asia or the slow-moving bureaucracy of Europe. Generic advice just doesn't cut it when you're on the ground, away from the main tourist trail.

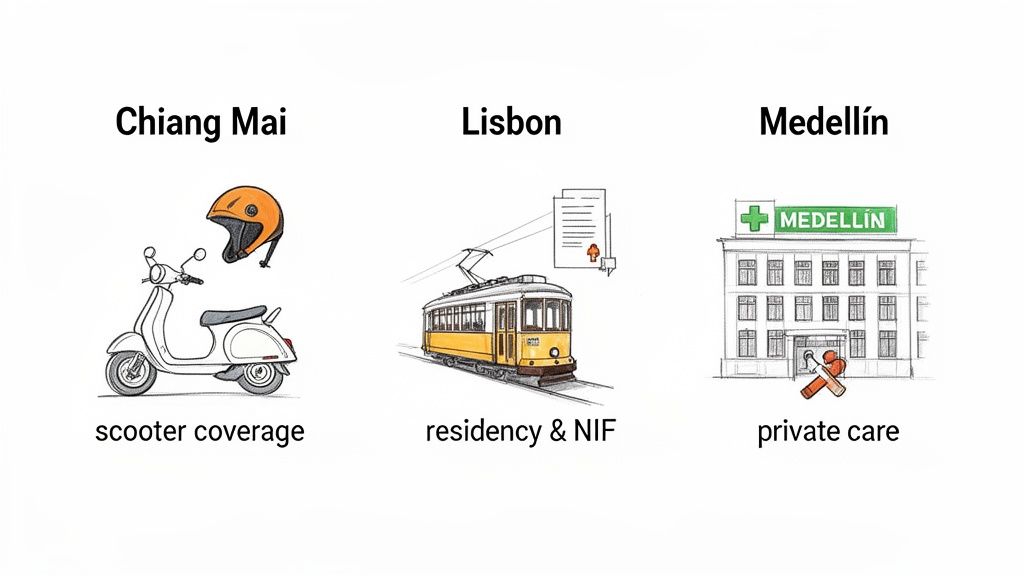

This is where a local guide's perspective is everything. A plan that’s perfect for one nomad hub might leave you dangerously exposed in another. We’ll break down the practical, need-to-know details for three major nomad destinations—Chiang Mai, Lisbon, and Medellín—to help you connect your insurance choice with local risks and get the most immersive experience.

Chiang Mai, Thailand: A Deep Dive into Local Realities

Chiang Mai is a rite of passage for digital nomads, loved for its amazing food, low cost of living, and buzzing community. But its laid-back vibe comes with some very specific risks that directly affect what you need from your insurance.

The biggest one? Scooters. It's how everyone gets around, giving you the freedom to explore every corner of the city and the mountains beyond. It's also the number one reason foreigners end up in the hospital here.

A standard insurance policy might seem okay until you hit the fine print. Many plans have an exclusion for "hazardous activities," a sneaky category that often includes riding a scooter, especially if you don't have the correct international license.

To stay covered, you absolutely must check that your policy explicitly covers accidents on two-wheeled vehicles. This might mean getting an "adventure sports" add-on. If you don't, you could be looking at a bill of $10,000 or more for a serious accident. Thailand’s private hospitals, like the excellent Chiang Mai Ram Hospital, deliver top-notch care but come with a hefty price tag. Direct billing is almost unheard of, so always be ready to pay upfront and file a claim for reimbursement.

Lisbon, Portugal: Insurance as Your Residency Key

Lisbon has exploded as a European hub for remote workers, thanks to its stunning architecture and the popular D8 digital nomad visa. In Portugal, your digital nomad health insurance is less about dodging immediate street-level dangers and more about satisfying the iron-clad rules of residency, allowing you to settle in for a full cultural experience.

When you apply for your visa and then your residency permit, the Portuguese authorities will go over your policy with a fine-tooth comb. They demand comprehensive coverage that’s valid across the entire Schengen Area, with a typical minimum of €30,000 in coverage. But the real test is in the details.

Your policy has to prove it covers everything—hospitalization, all medical expenses, and repatriation. A basic travel medical plan often won't make the cut; they strongly prefer a more substantial international health plan. This decision directly affects your ability to get your NIF (tax number) and complete the residency process. Here, your insurance certificate isn't just a safety net; it's a legal key.

Medellín, Colombia: Navigating the Healthcare Divide

Medellín, the "City of Eternal Spring," has blossomed into a major tech and nomad destination. While its modern transit and warm culture are big draws, you need to understand its healthcare system to stay safe, especially if you venture off the beaten path. Colombia basically runs a two-tiered system: the public EPS (Entidades Promotoras de Salud) and private clinics.

As a nomad, you’ll be using the private system almost exclusively. The care is excellent at clinics like Clínica El Rosario, but it costs a lot more. Because of this, your insurance plan needs to have a high coverage limit to handle any serious issues.

Beyond the city, the mountainous region of Antioquia is remote. If you’re planning on hiking or exploring places off the beaten path, robust medical evacuation coverage is completely non-negotiable. A simple fall on a trail could turn into a complex and incredibly expensive helicopter ride back to a top hospital in the city. Your insurance is the only thing standing between a beautiful weekend trip and a financial disaster.

A Stress-Free Guide to Filing a Claim Abroad

Let's be honest, your digital nomad health insurance is only as good as its claims process. When something actually goes wrong, you need a system that works without causing you more stress. Knowing how to handle a claim before you need to can turn a potential nightmare into a manageable hiccup. Think of it as your medical emergency fire drill; a little prep goes a long way.

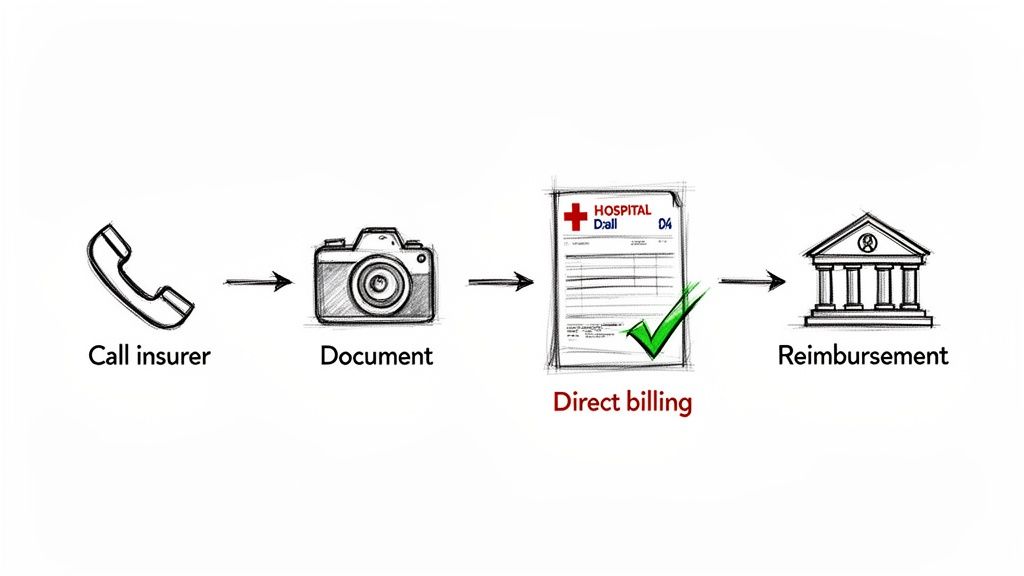

The second you feel that twinge or realize you need a doctor, your first instinct is probably to find the closest clinic. Hit pause for a second. Taking a couple of key steps before you walk through those hospital doors can save you a world of financial pain and paperwork headaches later on.

Your First Steps in a Medical Situation

Unless it's a true, life-threatening emergency, your very first call should be to your insurance provider. Seriously. This isn't just a friendly suggestion. They all have 24/7 global assistance hotlines for exactly this purpose.

That first call is everything. The person on the other end can point you to an in-network hospital, get your treatment pre-authorized so you know it’s covered, and walk you through the exact process for your policy. One phone call can be the difference between a covered claim and an accidental trip to an out-of-network clinic that leaves you on the hook for the entire bill.

Contacting your insurer before receiving non-emergency treatment isn't just a suggestion; for many policies, it's a mandatory step for the claim to be considered valid. Skipping it can be a costly mistake.

Direct Billing vs. Reimbursement

Once you get to the clinic or hospital, the next question is how the bill gets paid. It almost always falls into one of two buckets, and knowing the difference will help you manage your cash flow during a pretty stressful time.

- Direct Billing: This is the dream scenario. The insurer pays the hospital directly, and you're only responsible for your deductible or co-pay. It's clean, simple, and means minimal out-of-pocket cash. This is most common in major private hospitals that have deals with global insurance networks.

- Reimbursement: This is far more common, especially if you're in a smaller town or at a local clinic. You pay for everything upfront—the doctor’s visit, the medication, the tests. Then you gather up all your receipts and paperwork to submit a claim and get your money back from the insurer.

If you're in a reimbursement situation, documentation becomes your absolute best friend.

Mastering the Art of Documentation

To make sure your reimbursement claim sails through without a hitch, you need to transform into a paperwork-hoarding expert. Keep a dedicated digital or physical folder for everything related to your medical event. Don't leave the clinic without getting a copy of every single document.

Your claim submission will pretty much always need these four things:

- A Completed Claim Form: You can usually download this from your insurer's website. Fill it out as soon as you can while the details are fresh.

- Itemized Medical Bills: These need to break down the cost of every single service, medication, or supply you received. A simple credit card slip isn't enough.

- Proof of Payment: Always get official receipts that clearly show you've paid the bills in full.

- Doctor's Report or Medical Records: This is the document explaining your diagnosis, the treatment you were given, and any prescriptions.

Getting a well-documented claim submitted quickly is the final piece of the puzzle. Most insurers now have online portals that make uploading PDFs and photos super easy. Stay organized, be proactive, and you can get back to focusing on your recovery and the rest of your adventure.

Frequently Asked Questions

You've got questions, we've got answers. Sifting through insurance jargon can be a headache, so here are some straightforward takes on the most common things nomads wonder about.

Can I Just Use My Health Insurance from Back Home?

It's a nice thought, but almost always, the answer is no. Your standard domestic health insurance plan is built for life in one country. It usually offers zero, or extremely limited, coverage once you’re abroad for more than a short vacation. For the kind of long-term travel that defines the nomad lifestyle—and to meet visa requirements—it just won’t cut it.

What’s This Going to Cost Me? A Realistic Look at Monthly Premiums

The price tag on nomad health insurance can swing pretty wildly, but a good ballpark figure is anywhere from $50 to over $250 per month. What you actually pay depends on the usual suspects: your age, how comprehensive you want your coverage to be, where you're headed, and your deductible. Just know that any plan that includes the USA will jump up in price significantly.

A word of advice: Chasing the absolute cheapest plan is a recipe for disaster. Your non-negotiables should be solid emergency coverage and medical evacuation. Once you have that locked in, then you can start comparing prices.

What's the Difference Between a Deductible and Co-Insurance?

These two get mixed up all the time, but they have very different jobs. Think of it this way:

- A deductible is what you have to pay first, before your insurance company steps in. If you have a $500 deductible, you're on the hook for the first $500 of medical bills.

- Co-insurance is what you pay after you’ve hit that deductible. It’s a cost-sharing deal. With 20% co-insurance, once your deductible is paid, you’ll cover 20% of the remaining bill, and your insurer handles the other 80%.

I’m Already on the Road. Is It Too Late to Get Covered?

Nope, you're in luck. This is one of the best things about insurance designed for nomads. Unlike traditional travel insurance that you have to buy before your flight takes off, most digital nomad plans let you sign up from anywhere, anytime. It’s perfect for those of us whose plans change with the wind.

Ready to explore the world with the confidence that you're protected? At CoraTravels, we believe in making smarter, more informed travel decisions. Our local guides provide the knowledge you need for an immersive, off-the-beaten-path experience so you can embrace new cultures respectfully and safely. Find your next adventure at https://coratravels.com.